Manufactured Housing Production Rises in April 2024 per Manufactured Housing Association, But Bottlenecks Continue

Manufactured Housing Production Rises In April 2024 per data from the Manufactured Housing Association for Regulatory Reform (MHARR).

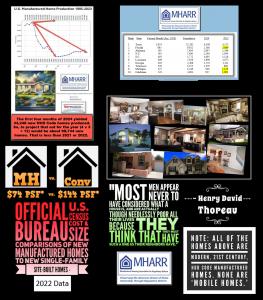

Manufactured Housing Association for Regulatory Reform Manufactured Home Infographic updated for April 2024 Data. Note click the image and follow the prompts to see this in a larger size.

The Evolution of Factory-Built Housing. From trailer houses in 1930s, to Mobile Homes (1950s-mid-1970s) to Manufactured Housing and modern Manufactured Homes.

Bottlenecks Suppressing Manufactured Housing Industry Continue Unabated, Says Manufactured Housing Association for Regulatory Reform Reports and Viewpoints.

A further analysis of the official industry statistics shows that the top ten shipment states from January 2023 — with monthly, cumulative, current reporting year (2024) and prior year (2023) shipments per category as indicated — are: (see graphic).

The April 2024 statistics move Tennessee into eighth place on the cumulative top-ten shipment state list, while Michigan falls to ninth place.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.- based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

In a related report from MHARR that sheds light on why manufactured housing is underperforming during a well-documented affordable housing crisis, MHARR said the following.

Bottlenecks Suppressing Manufactured Housing Industry Continue Unabated

The Manufactured Housing Association for Regulatory Reform (MHARR) in May 1, 2024 communications to both Federal Housing Finance Agency (FHFA) Director Sandra L. Thompson and U.S. Department of Housing and Urban Development (HUD) Acting Secretary Adrianne Todman (copies attached), has called for specific and immediate action to clear away the two principal bottlenecks that continue to suppress the production, marketing and availability of affordable, mainstream HUD Code manufactured housing in the midst of an unprecedented affordable housing crisis.

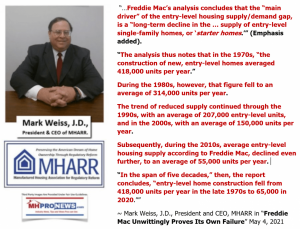

At a time when housing affordability in the United States has reached an all-time low according to press reports, the production of inherently affordable, mainstream manufactured housing, costing, on average, less than 25% of the price of an average site-built home, according to the most recent available annual U.S. Census Bureau data, fell more than 21% in 2023, to 89,169 homes. This marks the 15th year since 2007, that annual manufactured housing industry production has fallen below the crucial 100,000 home benchmark – a benchmark that was routinely and regularly exceeded in earlier years and decades.

While there are multiple factors having a negative impact on the affordable, mainstream manufactured housing market, there are two in particular that, over the long-term, have prevented the industry from reaching its full potential as the nation’s premiere source of affordable, non-subsidized homeownership. These post-production bottlenecks, specifically addressed in MHARR’s May 1, 2024 communications are: (1) the failure of FHFA and the FHFA-regulated Government Sponsored Enterprises (GSEs) (i.e., Fannie Mae and Freddie Mac), to provide any type of securitization or secondary market support for the dominant personal property consumer financing sector of the manufactured housing market under the statutory Duty to Serve Underserved Markets (DTS) mandate; and (2) HUD’s failure to utilize the enhanced federal preemption of the Manufactured Housing Improvement Act of 2000 (2000 Reform Law) (i.e., existing law) to invalidate – or even challenge – discriminatory and exclusionary zoning laws targeting manufactured housing and manufactured housing residents.

Because of the combined effects of the persistent failure of federal government agencies and related federal officials to comply with these clear and unambiguous statutory mandates, affordable manufactured homes are effectively banned (with no consequence) from many areas of the United States where the need for affordable homeownership is greatest, while millions of potential manufactured homebuyers are forced to seek purchase money loans at unnecessarily high and arguably excessive (or “predatory”) interest rates that can – and do – exclude many lower and even moderate-income Americans. Both such failures – in violation of applicable law — have inevitably undermined the affordable housing role of mainstream HUD Code manufactured housing and are unacceptable.

To be sure, the industry itself shares part of the responsibility and part of the blame for the continued existence and even exacerbation of both of these major failures. In particular, the industry’s national post-production representation has failed to hold these government agencies – FHFA and HUD – accountable for their long-term failure to comply with and vigorously enforce these statutory mandates for the benefit of American consumers of affordable housing. Instead, following an April 18, 2024 Senate “oversight” hearing, where neither agency head was pressed, at all, on their agencies’ fundamental long-term failure to support the availability of affordable manufactured homes in accordance with these statutory mandates, that representative – the Manufactured Housing Institute (MHI) — instead lavished praise on those officials. A long-time industry veteran later highlighted this clear and inexcusable disconnect, contrasting MHI’s baseless praise with the officials’ failure to deliver for the vast bulk of both consumers and the industry, stating: “So where does reality … end and 2024 gas lighting begin? Just what [do] FHFA and the GSEs really do in behalf and support of the manufactured housing industry?” He could have added, “what has HUD done, with the power and authority that it already has, to prevent zoning discrimination and the exclusion of manufactured homes that HUD itself regulates?”

In Washington, D.C., MHARR President and CEO Mark Weiss stated: “The needless long-term suppression of the mainstream manufactured housing market by these two major issues, in clear violation of applicable federal law, is an industry post-production problem that must be confronted by those entrusted with that responsibility. History shows that the HUD Code industry is capable of performing much better than it has over the past nearly-two decades. Clearing the zoning and DTS/personal property lending bottlenecks will go a long way to achieving this goal.”

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.- based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

https://manufacturedhousingassociationregulatoryreform.org/wp-content/uploads/2024/05/HUDactingSecAdrianneTodmanLetterManufacturedHousingAssocRegulatoryReformmharr.todmanmay24ltrReplica.pdf

https://manufacturedhousingassociationregulatoryreform.org/wp-content/uploads/2024/05/ManufacturedHousingAssocRegulatoryReformFHFADirector.thompsondtsapr24ltrReplica-1.pdf

##

In other news and updates from MHARR are the following.

MHARR — Issues and Perspectives “Reality Versus Empty Posturing”

https://manufacturedhousingassociationregulatoryreform.org/mharr-issues-and-perspectives-reality-versus-empty-posturing/

MHARR History and the FUTURE Of The HUD Code Industry

https://manufacturedhousingassociationregulatoryreform.org/mharr-history-and-the-future-of-the-hud-code-industry/

Updated About MHARR and MHARR leadership

Per MHARR's letter to the Biden Administration appointed acting leader of the Federal Housing Finance Agency (FHFA) and the Department of Housing and Urban Development (HUD) are the following pull quotes (see documents linked above).

"Hon. Adrianne Todman

Acting Secretary

U.S. Department of Housing and Urban Development

Re: Preempting Discriminatory Zoning Exclusion

of HUD-Regulated Manufactured Homes

Dear Acting Secretary Todman:

...We are writing to address a chronic and significant problem that has undermined the availability of inherently affordable, non-subsidized manufactured housing in many areas of the country, to the extreme detriment of American consumers of affordable housing, as well as the HUD Code manufactured housing industry, directly contrary to the fundamental mandate of the Manufactured Housing Improvement Act of 2000 (2000 Reform Law)."

"At an average sales price of $127,300, according to 2022 U.S Census Bureau data (the most recent available), a new HUD-regulated manufactured home costs consumers less than 25% of the price of a new site-built home ($540,000 according to the same 2022 Census Bureau data). Moreover, modern, energy efficient HUD Code manufactured homes, provide American consumers with inherently-affordable homeownership, without the need for costly taxpayer-funded subsidies, tax incentives, or other publicly financed programs."

"It is for this fundamental reason – inherently affordable homeownership, available to Americans at every income level – that Congress, in the watershed Manufactured Housing Improvement Act of 2000, unequivocally directed HUD to “facilitate the availability of affordable manufactured homes … for all Americans.” (42 U.S.C. 5401(b)(2))."

"Yet, today, nearly a quarter century following the enactment of the 2000 Reform Law, HUD still has not implemented one of that law’s most important provisions, related directly to the availability of affordable manufactured homes in all areas of the United States. Specifically, HUD has failed to utilize the enhanced federal preemption provided by the 2000 Reform Law to invalidate (or even challenge) discriminatory zoning laws and ordinances which exclude mainstream HUD-regulated manufactured housing from many areas of the United States."

The amendment adopted in the 2000 Reform Law, expanded the reach of federal preemption under pre-existing law to broadly address any state or local “requirement” that interferes with HUD’s “superintendence” of manufactured housing and the manufactured housing industry. And, to make absolutely clear that this mandate includes the preemption of exclusionary and discriminatory zoning “requirements,” the leading congressional proponents of the 2000 Reform Law wrote to the then-HUD Secretary in 2003, that the “combined changes [in the law] have given HUD the legal authority to preempt local requirements or restrictions which discriminate against the siting of manufactured homes (compared to other single family housing) simply because they are HUD Code homes.” (See, copy attached hereto).

HUD’s long-term failure to enforce this enhanced federal preemption in order to eliminate discriminatory and exclusionary zoning requirements in many areas, including large areas of urban and suburban America, where the need for affordable housing is greatest, has not only harmed and restrained the HUD Code manufactured housing industry – which, in 2023 saw production levels shrink again to below 100,000 homes – but is an extreme disservice to millions of lower and moderate-income Americans in need of affordable homeownership.

Acting Secretary Todman, the 2000 Reform Law is clear and unequivocal – affordable, nonsubsidized, mainstream HUD Code manufactured housing must be an available option for all Americans as a national housing priority that is not subverted by the parochial prejudices or biases of local governments or authorities. It is HUD’s solemn responsibility to enforce that statutory directive and thereby help ensure housing affordability. HUD, accordingly, should take aggressive action to end zoning discrimination against manufactured housing and manufactured housing residents, and seek, as necessary, all appropriate administrative and judicial remedies toward that end..."

Some pull quotes from MHARR's letter to FHFA Director Sandra Thompson follow.

"Hon. Sandra L. Thompson

Director

Federal Housing Finance Agency

Re: Manufactured Housing – Duty to Serve Underserved Markets

Dear Director Thompson:

...Specifically I am referring to the ongoing, continuing and total failure of both Fannie and Freddie to implement the statutory Duty to Serve Underserved Markets (DTS) with respect to the dominant personal property financing sector of the manufactured housing market. FHFA’s recently published (April 2024) “2023 Housing Mission Report” and your subsequent testimony at an April 18, 2024 Senate oversight hearing, were both extremely disappointing, insofar as it appears from both such sources that FHFA -- as the federal regulator of Fannie Mae and Freddie Mac -- has decided to turn its back on the Duty to Serve and allow both of the Government Sponsored Enterprises (GSEs) to ignore that statutory duty altogether, particularly with respect to manufactured housing personal property financing. This is especially significant given that the most recent available U.S. Census Bureau data (2022), shows that 73% of all manufactured home placements are titled as personal property, as contrasted with only 21% titled as real estate (This

measure, moreover, which corresponds with financing types, is consistent with data going back to 2009, which shows that the average historical proportion of manufactured homes financed as personal property is just over 76%).

...At a time when housing affordability is at an all-time low, with even FHFA admitting, in the aforesaid

2023 Housing Mission Report, that “homebuyers and renters alike faced difficulties in acquiring homes they

could afford,” it is both astounding and extremely disappointing that the same report devotes just a page

and-a-half to “Manufactured Housing Initiatives” and, even worse, demonstrates that Fannie and Freddie,

to date, have done exactly nothing to implement DTS for the vast bulk of mainstream manufactured home

purchasers who rely on personal property financing.

...Director Thompson, the time for talk and meaningless displays regarding DTS implementation is long past. DTS, including support for manufactured housing personal property loans is law and must be enforced to require the market-significant support of manufactured home personal property loans now. Without such action, FHFA is not only failing to help alleviate the current affordable housing crisis, but is actually contributing to it and, together with Fannie and Freddie, is causing a manufactured housing availability bottleneck that is incredibly detrimental to Americans in need of affordable housing.

If you deem the DTS law to be unclear or not sufficiently robust to compel the needed action by Fannie and Freddie, then FHFA can ask Congress for further clarification or authority, and indeed you clearly had the opportunity to do so when you were before Congress on April 18, 2024, but you did not.

The non-implementation of DTS with respect to the vast bulk of mainstream manufactured home consumer loans represented by personal property notes is handicapping the industry – which saw significantly reduced production levels in 2023 – from helping solve the nation’s housing crisis for those who seek truly affordable homeownership. This needless stasis is a disservice to millions of Americans and must be remedied. Therefore, we will contact your office soon to schedule a meeting that should include senior representatives of both Fannie Mae and Freddie Mac in order to seek a resolution of this matter once and for all."

The full text of those letters to HUD's Todman and FHFA's Thompson are found as attachments in the MHARR report linked below.

https://manufacturedhousingassociationregulatoryreform.org/bottlenecks-suppressing-manufactured-housing-industry-continue-unabated/

MHARR's latest on the DOE energy rule issue is linked below.

https://manufacturedhousingassociationregulatoryreform.org/department-of-energy-doe-manufactured-housing-energy-rule-litigation-report-and-update/

MHARR CEO Mark Weiss' views on a range of manufactured housing industry connected topics are linked below. MHARR clearly supports the use of correct terminology for manufactured homes, which as they have explained, are no longer the "trailer houses" or "mobile homes" of yesteryear prior to the dawn of the manufactured housing era on June 15, 1976.

https://manufacturedhousingassociationregulatoryreform.org/category/mharr-issues-and-perspectives/

Insights and viewpoints from MHARR's senior advisor, Danny Ghorbani, a former Manufactured Housing Institute vice president who left that trade group to become the founding president and CEO of MHARR are found linked below.

https://manufacturedhousingassociationregulatoryreform.org/mhpronews-qa-with-danny-ghorbani/duty-to-serve-mh/

###

Mark Weiss, J.D.

Manufactured Housing Association for Regulatory Reform

+ +1 202-783-4087

email us here

Visit us on social media:

Facebook

X

LinkedIn

YouTube

Other

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.